Public-Private Partnerships (P3s) in higher education continue to grow across several dimensions, including services/assets where the P3 approach is applied and evolution of different payment models.

Beyond Undergraduate Student Housing

Interest in housing P3s has expanded beyond traditional housing for undergraduates. The number of P3 deals for undergraduate student housing continue to grow but there has also been an increase in interest/deals for other housing types including partnerships for facilities marketed to graduate students, families, faculty and retirement community living.

Applying P3 Across the Institution

In a recent survey asking institutions what areas they are considering for partnerships, “development of other campus facility/infrastructure”, “online program expansion” and “leveraging current assets (e.g., energy, parking)” all had higher interest than “student housing”[i].

This interest in partnerships to deliver assets/services beyond undergraduate student housing is evident in the sample of higher education P3 projects announced or completed in the past 18 months.

Undergrad Housing

- Illinois State

- Lake Superior State

- Purdue University

- Texas Woman’s University

- UC – Davis, Santa Crus, Riverside

- University of Illionos Chicago

Energy/Utilities

- Dartmouth

- Fresno State

- Louisiana State

- UMD – College Park

- University of Illinois

- University of Iowa

- Wayne State

Facilities/Mixed Use Development

- Georgia State University

- Kent State

- University of Hawaii

- University of Illinois

- University of Kansas

Grad Housing

- Notre Dame

- Purdue University

- University of Hawaii

Parking

- East Michigan University

- Kent State

Hotels

- Metropolitan State University

- UMD – College Park

Sports Arena

- UConn

- UT – Austin

(Online) Program Management

- American University

- Concordia University

- George Mason

Other

- North Carolina State (Campus-wide Marketing)

- Arizona State (Corporate Learning Services)

P3 Structures: Demand-risk, Availability Payment and Hybrid Approaches

P3s Moving Forward

|

Positives

|

Negatives

|

|---|---|

|

Private Market Expertise

|

Contact Management

|

|

Outside Capital

|

Higher Cost of Capital

|

|

Speed to Delivery

|

Reduced Control

|

|

Innovation and Technology

|

Partner Risk

|

|

Risk Allocation

|

Risk Allocation

|

[i] Blumenstyk, Goldie, “College Leaders Are Getting Serious About Outsourcing. They Still Have Plenty of Concerns, Too,” The Chronicle of Higher Education, March 26, 2019, https://www.chronicle.com/article/College-Leaders-Are-Getting/245978 (accessed May 20, 2019).

About the Author:

Justin Krieg Ph.D. – Vice President

Justin joined Blue Rose in May 2018, and serves as our lead advisor for litigation support services and price analysis. Justin also provides services to clients for P3 transactions. Justin can be reach by phone at: 952-746-6045 or by email at: [email protected].

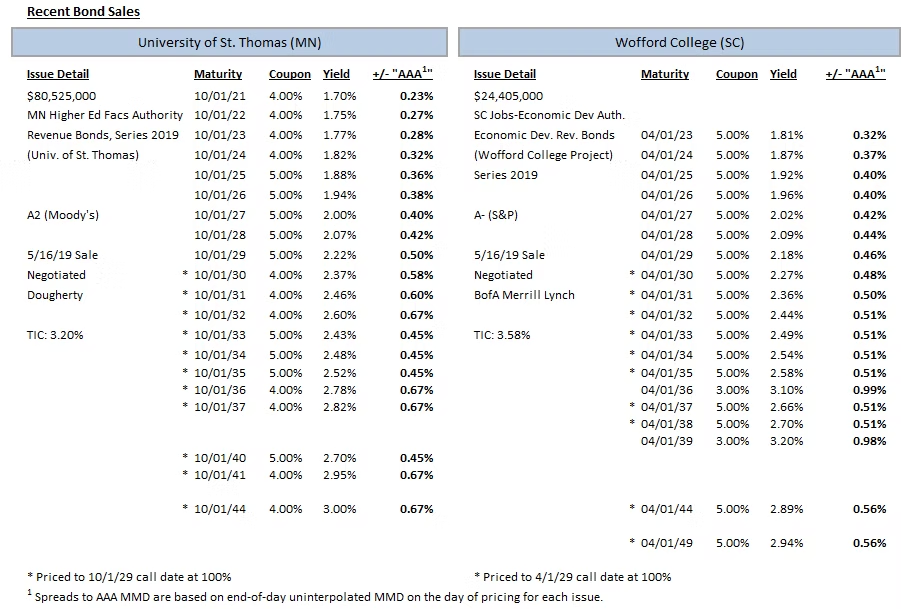

Comparable Issues Commentary

Shown below are the results of two negotiated, tax-exempt private higher education issues that sold in the month of May. The University of St. Thomas, rated A2 (Moody’s), and Wofford College, rated A- (S&P), each priced their bond issues on May 16th. Both institutions sold their bonds solely for new money purposes. St. Thomas’s Series 2019 issue will serve to finance two significant new student residence halls (one for first-year and one for second-year students). Wofford’s Series 2019 bonds also were substantially allocated to the construction of one residence hall and the renovation of another, along with the renovation of its library and construction of a new environmental studies science facility and new athletic facilities. A sizeable portion ($14 million) of Wofford’s project costs is planned to be financed through fundraising, with a pledge for the funds already in place, while St. Thomas’s projects are planned to be funded fully from the bond proceeds.

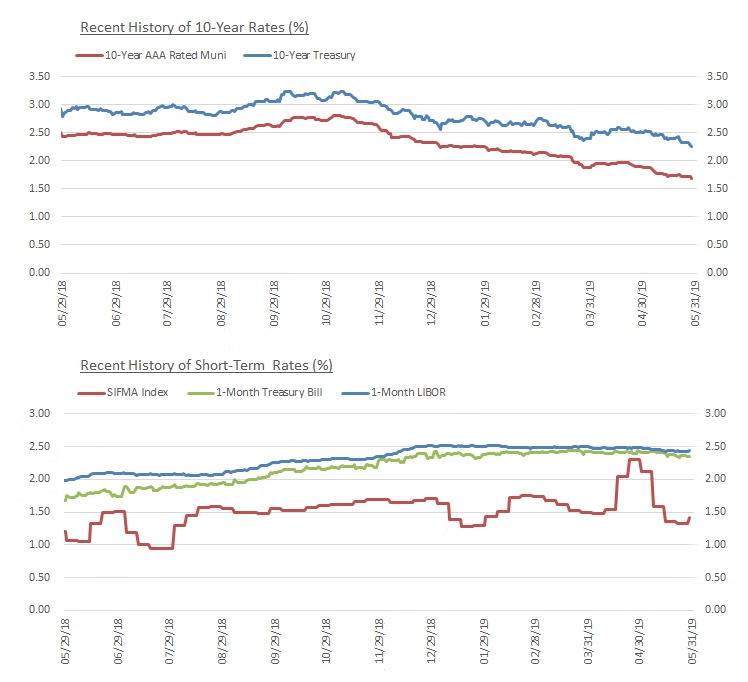

The two deals priced into a fairly strong market environment, with borrowing rates falling steadily for most of the spring. On both issues’ pricing date of May 16th, the MMD curve steepened somewhat but did not move drastically, with reductions of 2 bps from 2020-2025, no change in 2026, 1 bp increases in 2027 and 2028, and an increase of 2 bps from 2029-2049.

Wofford’s deal was structured with a 30-year final maturity, in contrast to a shorter 25-year maturity for St. Thomas – however, both institutions used debt service structures that were primarily level. Wofford’s bonds amortize with purely level debt service after 3 years of interest-only payments, while St. Thomas utilized more of a step-up structure after its 2-year interest only period, with annual debt service gradually increasing from FY 2022 through FY 2030 before levelling off at roughly $5.8M/year thereafter. Each school also chose to capitalize interest for multiple interest payments, providing debt service relief during the construction periods of their respective projects.

The call features of the two deals were similar as well, with both schools opting for standard 10-year par call options on their 2019 bond issues. However, the coupon structures of the two transactions varied in key facets. While Wofford primarily utilized 5% premium coupons throughout its callable maturities, with just two 3% discount coupons interspersed as serial bonds in 2036 and 2039 for additional diversity, St. Thomas opted for much more overall variety, with more 4% coupons than 5% coupons in its callable bonds. Only the 2033-2035 callable serial maturities and the 2040 term bond were sold with 5% coupons, while the remaining callable bonds, including the final term bond in 2044, were sold as 4% maturities. St. Thomas’s 4% maturities priced at spreads roughly 22 bps above their callable 5% coupons, while Wofford’s 3% discount maturities priced at spreads 47-48 bps above its own callable 5% maturities.

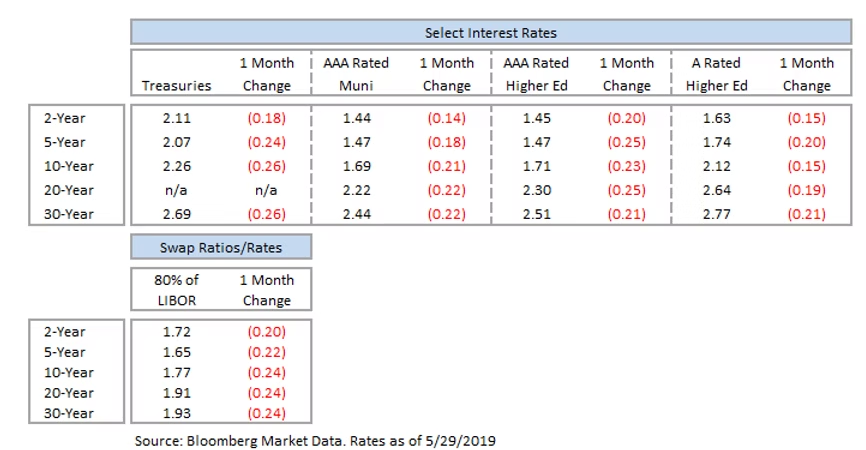

Interest Rates