FY2018 Rating Medians are Out: Credit Analysts Report Similar Trends Within Higher Education

- Blue Rose Marketing

- Jul 31, 2019

- 7 min read

By: Adrienne Booker

Over the last two months, S&P Global Ratings (S&P), Moody’s Investors Service (Moody’s) and Fitch Ratings Inc. (Fitch) released their respective FY2018 median reports for the public and private higher education sector.1 These annual reports provide a useful gauge for issuers, investors and intermediaries about important trends throughout the sector. While there are similar themes in all three rating agencies’ FY2018 median reports, readers should be mindful of the different sample sizes, methodologies and ratio calculations applied by each firm when evaluating and comparing the median results.

Growing Credit Gap

Most of the S&P, Moody’s, and Fitch-rated colleges and universities that are included in the FY2018 median reports fall within the ‘AA’ and ‘A’ rated categories. While each rating agency provides independent and relatively distinct reporting and commentary about their median results, the three agencies similarly note a widening divergence between higher-rated (‘AA’ category and above) and lower-rated institutions (‘BBB’ category and below). Schools within the higher rated categories generally demonstrate solid demand and enrollment metrics, financial flexibility, a growing endowment and diverse programing. Conversely, institutions that are on the lower end of the rating scale are generally smaller, regional schools facing enrollment challenges, possible demographic shifts, limited revenue diversity and strained operations.

Key Median Observations – Public Institutions

Mixed operating performance: For public institutions, S&P’s median report reflects mixed operating performance results showing increases for higher rated credits and declines at the lower end. Overall, the net adjusted median operating margin improved to 0.5% in FY2018 from -0.1% in the prior year. However, this modest improvement masks the true performance of public institutions rated by S&P when evaluated by rating category. Specifically, the ‘AAA’ rated net adjusted operating margin increased to 3.6% in FY2018 compared to the -1% and -5% results reflected in the ‘A’ and ‘BBB’ rated categories, respectively. The operating performance for the ‘BBB’ category deteriorated significantly compared to FY2017 results. The speculative grade public institutions’ net adjusted operating income improved to 6.5% because of retroactive state appropriation funds for FY2017 that were received in FY2018. This improvement by the non-investment grade public institutions in Illinois skews the median data and does not accurately reflect the growing gap between higher rated and lower rated institutions.

Moody’s FY2018 median operating ratios depict similarly mixed results from a rating category perspective. The median operating margin for public institutions as measured by Moody’s modestly increased to 1.9% in FY2018 from 1.4% in the prior fiscal year. The median for ‘AAA’ rated public institutions slightly declined to a moderate 2.6% in FY2018 from 2.8%. Conversely, the median operating margin for ‘Baa’ rated category institutions continue to significantly decline having dropped to -2.1% from -1.3% in FY2018.

Fitch also shows evidence of the widening credit gap in its operating performance ratios. In FY2018, the median adjusted operating margin for public institutions improved to 0.9% from -0.5% in the prior fiscal year. While the ‘AAA’ operating margin increased to 2.2% for FY2018, the ‘A’ median was -4.0%, albeit a slight improvement over the prior year. It is important to note that Fitch’s rated portfolio sample size for public institutions is small (compared to S&P and Moody’s) and does not contain any ratings below ‘A’.

Enrollment Declines Despite Growth in Higher Rated Categories: For FY2018, S&P reported a modest 1% decrease in full time equivalent (FTE) median enrollment. However, FTE enrollment increased for ‘AAA’, ‘AA’ and ‘A’ rated public institutions. This is due largely to brand recognition, diverse programing and financial flexibility to address facility updates. Conversely, peer institutions rated in the ‘BBB’ category declined 2.7% due to weaker financial and demand fundamentals. Moody’s reported similar results for its rated public institutions with a modest decline in FTE median enrollment. Even so, medians for the ‘Aaa’ and ‘Aa’ categories increased, compared to declines at the ‘A’ and ‘Baa’ rating levels. While Fitch does not specifically provide FTE enrollment medians in its FY2018 report, the agency states that “enrollment challenges were a noted rating factor in the great majority of Fitch’s downgrades.”

Key Median Observations – Private Institutions

Enrollment Growth Despite Sector Challenges: For FY2018, S&P reported modest FTE enrollment increases across all rating categories despite enrollment pressures on small, regional institutions and entities facing heightened competition. According to S&P, the enrollment increases may be attributable to expanded efforts to counter undergraduate enrollment challenges with new programs for graduate and professional students or other strategies to accelerate student recruitment and retention efforts. The growth in graduate programs is supported by relatively flat or declining results when observing S&P’s medians for undergraduates as a percent of total enrollment. The likely increase in private institution enrollment, specifically on the lower end of the rating scale may be due to more competitive financial aid packages and increased tuition discounting as a strategy to attract more students. Moody’s median report reflects an increase in all rating categories with the exception of the ‘Baa’ category, where there is nearly a 1% decline in FTE enrollment.

Operating Performance Underscores Sector Challenges: S&P’s median report shows an overall decline in financial operations, which underscores the challenges that many private institutions are facing; this is coupled with the sector’s heavy dependence on student-generated revenue. For FY2018, the median net adjusted operating margin dropped to 0.8% from 1.3% in the prior fiscal year. Institutions at the ‘AAA’, ‘AA’ and ‘A’ levels exhibited flat or slightly increased operating margin growth. However, the ‘BBB’ and non-investment grade categories showed weaker median net adjusted operating margins at -0.6% and -2.2%, respectively. Moody’s median report reflects similar overall results with an FY2018 median operating margin at 3.3%, a decrease from 4% in the prior fiscal year. Unlike S&P’s medians, Moody’s category-specific operating margins show slight to moderate declines at the ‘Aaa’, ‘Aa’ and ‘A’ levels for FY2018 in addition to a significant decline in the ‘Baa’ rated category.

Similar to S&P, Fitch’s operating performance ratios reflect the widening between higher rated and lower rated private institutions. Fitch’s adjusted operating margin, which includes endowment draw, decreased to 2% in FY2018 from a moderate 2.7% in the prior fiscal year. While the median for the ‘AAA’ rating category increased to 5.3% for FY2018, the ‘AA’ category median slightly declined to 2.4% from 2.7% in FY2017. Conversely, the median adjusted operating margins for ‘Baa’ and noninvestment grade categories are weaker at 1.8% and -1.2%, respectively.

FY2018 Median Results Support Sector Outlook

The S&P, Moody’s and Fitch FY2018 median reports highlight the widening credit gap between higher rated and lower rated (‘BBB’ category and below) institutions. The median results also support the sector’s credit outlook for the 2019 calendar year. S&P and Moody’s each maintained their negative outlooks on the sector from the previous year, while Fitch revised its sector outlook for 2019 to negative from stable.2 Although the stated bases for the negative outlooks vary, operating/net tuition revenue pressures and growing expenses are consistent themes among the rating agencies. While it may appear that financial challenges within the private college and university sector are more severe, it is important that both public and private institutions, especially those that are at the lower end of the rating spectrum, implement creative and adaptable strategies to stabilize their financial and operating positions in order to remain successful.

1 The information in this article is based on the following median reports published by S&P, Moody’s and Fitch:

“U.S. Public College and University Fiscal 2018 Median Ratios: The Disparity Between Higher- And Lower-Rated Entities Persists,” published June 25, 2019 by S&P.“U.S. Not-For-Profit Private Universities Fiscal 2018 Median Ratios: Overall Stability Continues Despite Lingering Issues,” published June 25, 2019 by S&P.“Higher Education – US Medians – Public University Revenue Growth Declines Again, Driving cost Containment,” published June 27, 2019 by Moody’s.“Higher Education – US Medians – Private Universities’ Low Revenue Growth Tightens Operating Performance,” published June 27, 2019 by Moody’s “Fiscal 2018 Median Ratios for U.S. Colleges and Universities,” published July 12, 2019 by Fitch.

2 For additional information regarding rating agencies’ 2019 outlook for the higher education sector, see the following research:

“Global Not-For-Profit Higher Education 2019 Sector Outlook: Credit Pressures Proliferate,” published January 24, 2019 by S&P. “Higher Education – US – 2019 Outlook Remains Negative With Continued Low Net Tuition Revenue Growth,” published December 4, 2018 by Moody’s.“Fitch Ratings 2019 Outlook: U.S. Public Finance Colleges and Universities,” published December 6, 2018 by Fitch.

__________________________________________________________________________________

About the Author

Adrienne Booker, Vice President

Adrienne joined Blue Rose in July 2018. She has over 20 years of experience in public finance. Ms. Booker provides financial advisory services to Blue Rose’s clients and lends her expertise in bond structuring, executing bond transactions and municipal credit analysis.

__________________________________________________________________________________

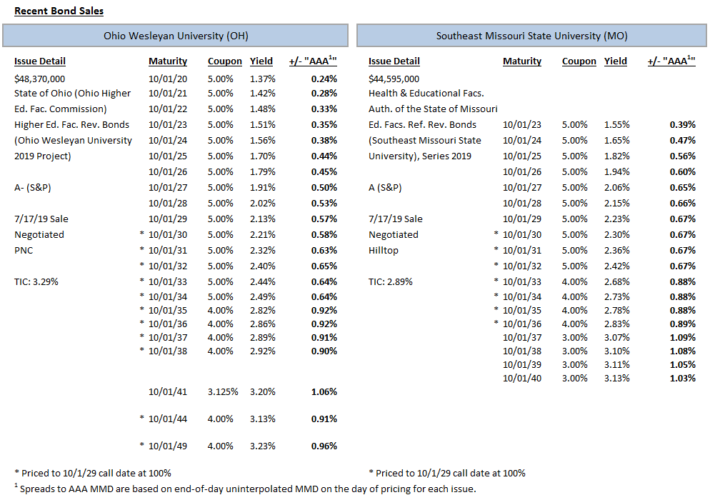

Comparable Issues Commentary

Shown below are the results of two negotiated, tax-exempt higher education issues that sold in the month of July. Ohio Wesleyan University and Southeast Missouri State University each priced their bond issues on July 17th. Both deals were similar in size (each with total par amounts between $44 and $49 million) and sold with a single rating from S&P – “A” with a negative outlook for Southeast Missouri State, and “A-“ with a stable outlook for Ohio Wesleyan. Ohio Wesleyan’s deal carried both new money and refinancing components, with proceeds used to refinance its Series 2015 Bonds and Series 2011 Loan as well as the funding of construction and renovation projects for Smith Hall and other residence life facilities on campus. Southeast Missouri State’s deal was a pure refunding issue that served to advance refund the University’s Taxable Series 2010B Build America Bonds (“BABs”) on a tax-exempt basis. Both deals priced into a positive time in the market, with the economic environment continuing to drive tax-exempt interest rates down during the month of July. On the 17th MMD was reduced modestly across the curve (down 1 bp in 2020 and 2 bps across all other maturities).

Ohio Wesleyan’s issue was structured with a 30-year final maturity in 2049, while Southeast Missouri State’s bonds carried a shorter final maturity in 2040, possibly due to the lack of a new money component. Structurally, the two deals were extremely similar in most respects, with primarily level debt service payments, serialized bond structures through the first 20 years of the curve (Ohio Wesleyan did, however, utilize 3 term bonds after the 20-year point in 2041, 2044, and 2049), and matching 10-year par call options. Even the coupon structures of the two deals were relatively paralleled, with both Universities using 5% coupons on earlier maturities before graduating to lower 4% and 3% coupons later down the curve, although Ohio Wesleyan utilized 5% coupons for more maturities (from 2020 through 2034 compared to Southeast Missouri State’s 5% coupons from 2023-2032). Ohio Wesleyan’s 5% callable maturities priced at spreads ranging from +58 to +65 bps above AAA MMD, with its 4% maturities ranging from +90 bps to +96 bps. Southeast Missouri State’s callable 5% coupon bonds priced at spreads of +67 bps to MMD, while its 4% coupons were sold at spreads of +88-89 bps.

_________________________________________________________________________________

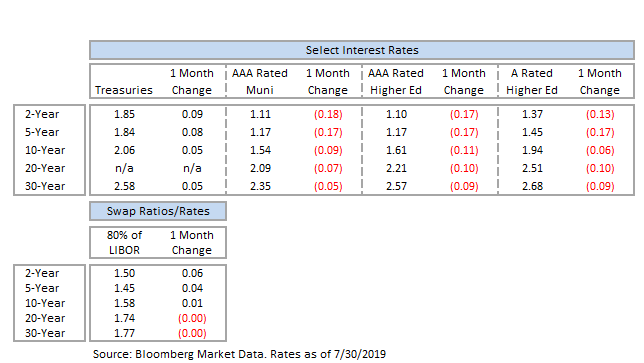

Interest Rate Charts

Comentarios