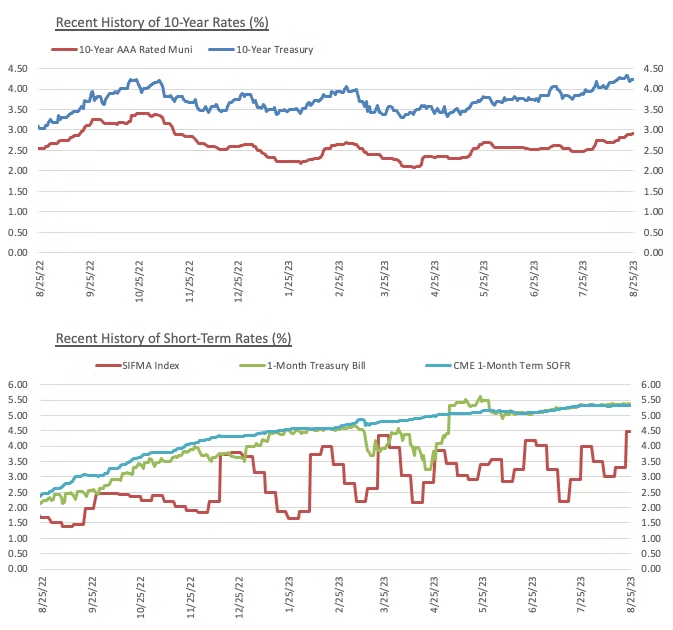

LIBOR cessation occurred as scheduled on June 30th of this year and most variable instruments that historically referenced LIBOR should now reference a different index. Depending on your last reset period, your debt instruments could still be utilizing a LIBOR rate for your current interest accrual period, however, with interest accrual periods thereafter referencing a different rate, likely some form of SOFR.

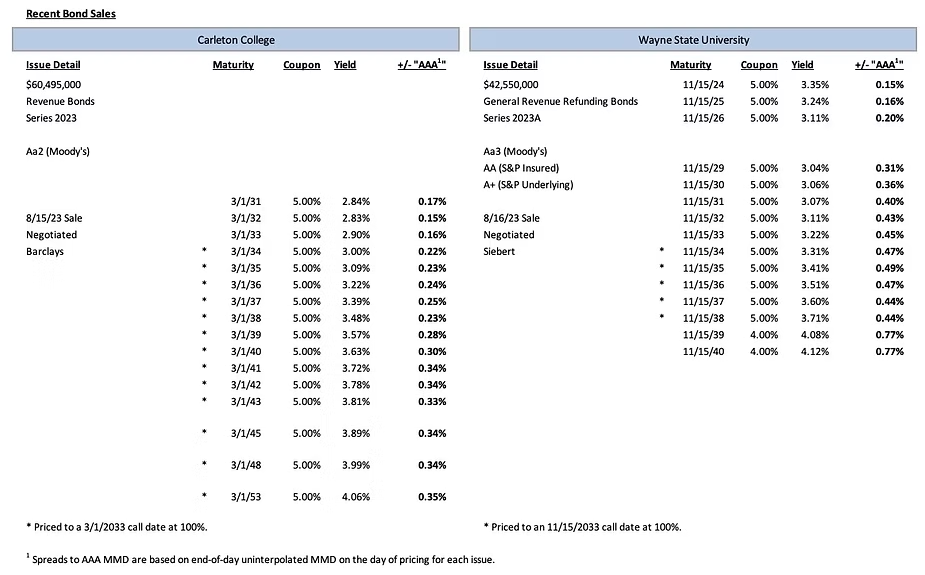

Comparable Issues Commentary

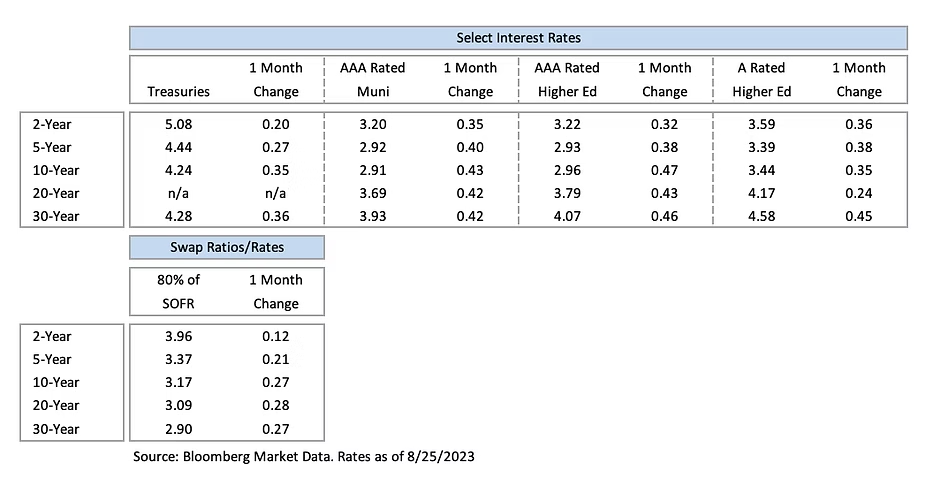

Interest Rates

Meet the Author:

Brandon Lippold | [email protected] | 952-746-6054

Brandon Lippold joined Blue Rose in 2018 as a Quantitative Analyst, now in his role of Vice President, he is focused on growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing. He has significant expertise in direct purchase bonds, and derivative products and is experienced with the pricing and execution of fixed rate bond transactions, and reinvestment products. Mr. Lippold is closely involved in every step of the financing process for clients, from initial capital planning stages all the way through closing.

Media Contact:

Megan Roth, Marketing Manager

952-746-6056