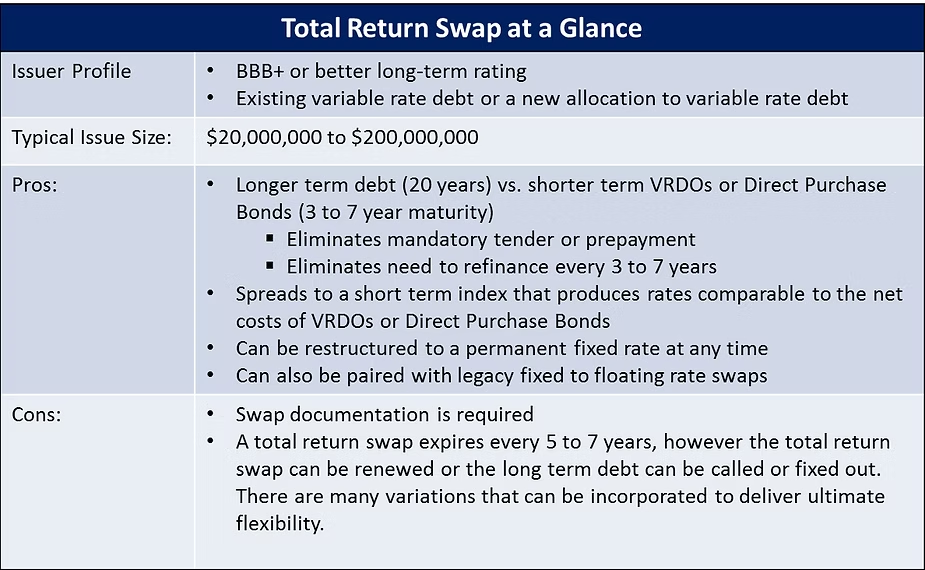

Total return swaps issued in combination with long term fixed rate notes or 20-year fixed rate debt are a viable alternative for tax-exempt issuers that typically issue Direct Purchase Bonds or Variable Rate Demand Obligations as a source of capital funding. Blue Rose can help you evaluate whether a total return swap would be a structure you should consider with future financings.

How Total Return Swaps Work

The total return swap is structured to receive the payment obligation on the debt and pay 70% of 1-month LIBOR (or SIFMA) plus a Spread (30-50 bps) for five years. Unlike plain interest rate swaps, total return swaps are not valued using the LIBOR curve. The mark-to-market (“MTM”) value of a total return swap is determined by the MTM premium or discount of the long term debt, which is designed to hover near par. Every five to seven years the total return swap will mature and a new total return swap can be put in place or the long term debt can be called or fixed out.

The total return swap structure accomplishes long term committed funding, without renewal risk, at spreads to a short term index that are competitively comparable to VRDOs and Direct Purchase Bonds.