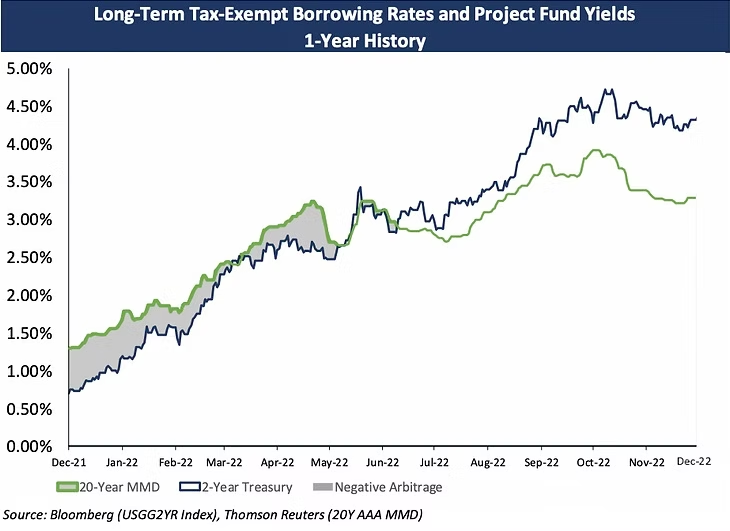

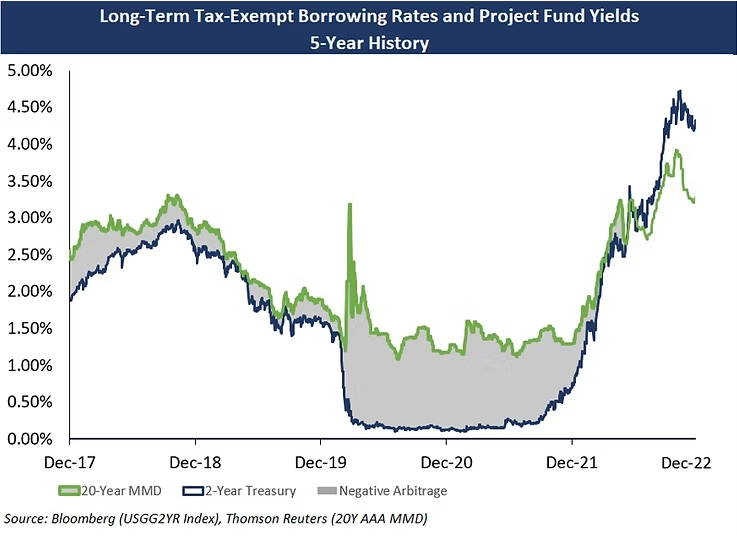

In 2022, short-term interest rates rose significantly. This was an obvious trend that captured many headlines throughout the year. What may have been less apparent to market participants was the fact that about mid-way through the year, we began seeing consistent opportunities for positive arbitrage between 20-year tax-exempt borrowing rates and 2-year reinvestment rates for the first time in over fifteen years. Since then, the gap between these rates has only increased, creating an opportunity for either greater positive arbitrage or a greater certainty of achieving positive arbitrage upon the reinvestment of bond proceeds.

Prior to 2022, reinvestment rates hovered around 0% for almost two years, beginning in March 2020 at the onset of the COVID-19 pandemic. It wasn’t until the beginning of 2022 that reinvestment rates reached over 1.00%. In February, the 2-year treasury rate hit 1.50% for the first time since January 2020, and while that seemed very significant at the time, it would only continue to rise from there. Towards the end of 2022, the 2-year treasury rate was hovering around 4.50% – a level that it hasn’t reached since 2007.

The significant market changes that we have seen over the last 12 months have created an opportunity for issuers to earn a meaningful amount of interest on the reinvestment of their bond proceeds. For tax-exempt borrowers who are coming to market with new money issuances in 2023, or have outstanding unspent bond proceeds, we strongly encourage you to consider the most efficient reinvestment options and to execute in a manner that meets the IRS safe harbor provisions.

Below we show current reinvestment rate indications. For a more tailored reinvestment indication to your specific fund(s) and discussion of the risks and benefits to each type of reinvestment structure, reach out to Georgina Walleshauser at Blue Rose Capital Advisors.

|

Average Life

|

GIC

|

Repo

|

Portfolio

|

|---|---|---|---|

|

1-year

|

4.98%

|

4.85%

|

4.68%

|

|

2-year

|

4.74%

|

4.39%

|

4.34%

|

|

3-year

|

4.62%

|

|

|

*Indicative rates as of January 3rd, 2023.

Meet our Author:

Georgina Walleshauser, Assistant Vice President | 952-746-6036

Georgina Walleshauser joined Blue Rose in 2017 as an Analyst, providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. In the role of Associate, she utilized her experience as an Analyst in a more client-facing role, while still performing much of the analysis utilized in this capacity. In her role of Vice President, she will be tasked with growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing.

Media Contact:

Megan Roth, Marketing Manager

952-746-6056