In past newsletters, we’ve often discussed the impact of an inverted yield curve environment on refunding escrows. Specifically, we’ve explained in detail the idiosyncrasies caused by an inverted yield curve that led to State and Local Government Series (SLGS) escrows outperforming open market securities (OMS) escrows (Comparing SLGS and OMS Escrow Portfolios in the Current Market). Those conditions no longer exist.

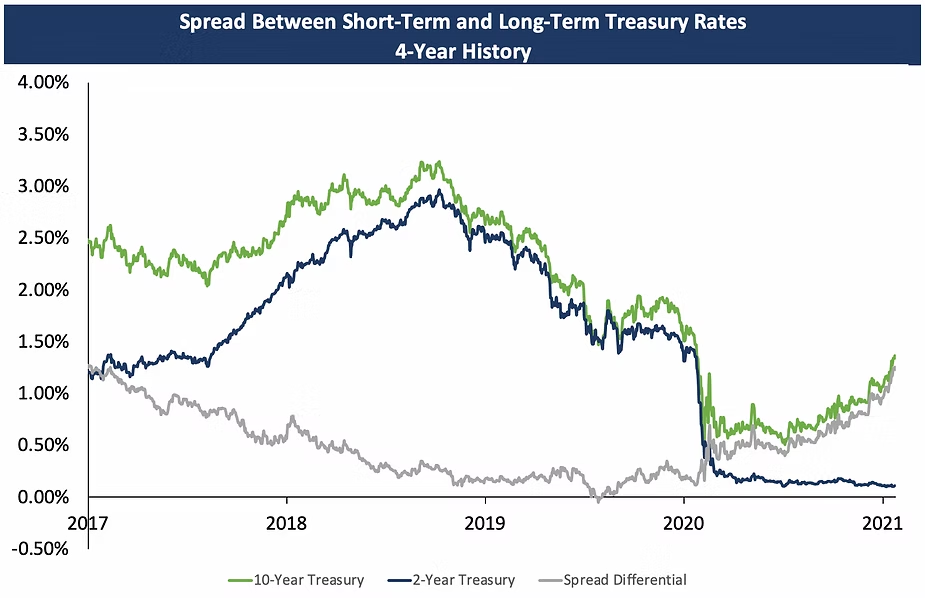

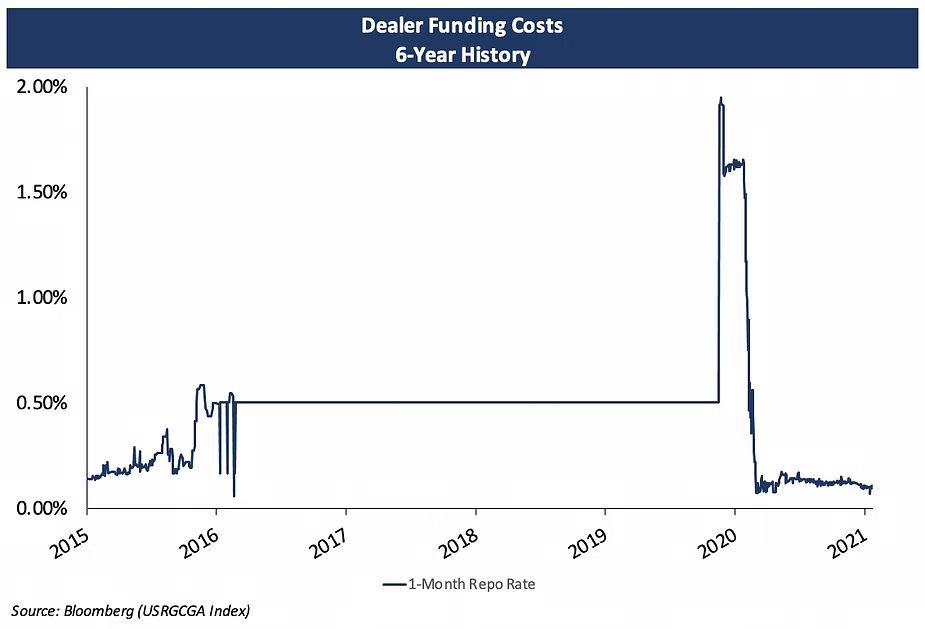

In the current market, the yield curve is no longer inverted and in fact is steeper than it has been during the past four years (see chart below). As a result, the idiosyncrasies caused by the SLGS rate setting mechanics are once again in the borrower’s or issuer’s favor. With a normal, positively sloped yield curve, SLGS will typically yield slightly less than their respective OMS. Further, dealers’ funding costs on the front end of the curve are near historic lows (see chart below), resulting in additional yield for an escrow settling several weeks after bond pricing. Depending on the size of the escrow requirements and its final requirement date, as well as the universe of permitted OMS, the benefit of OMS to SLGS portfolios can vary greatly. For smaller, shorter dated escrows, the benefit may be too small to cover fees associated with bidding an OMS escrow. However, and as we’ve seen on various escrows in the past several months, larger and longer dated escrows can benefit greatly. Recently, we bid an OMS escrow with a total cost of approximately $43 million that outperformed SLGS by more than $275,000 after accounting for all related fees. We encourage you, as always, to reach out to your Blue Rose advisor for an indicative escrow cash flow analysis to determine if an open market escrow can be expected to provide value for your escrow transaction.

About the Author:

Georgina Walleshauser, Associate

Georgina Walleshauser joined Blue Rose in 2017. As an Associate, she is responsible for providing analytical, research, and transactional support to senior managers serving higher education, non-profit, and government clients with debt advisory, derivatives advisory, and reinvestment services. She also prepares debt capacity modeling, credit analysis, and market analysis to support the delivery of comprehensive, strategic, and resourceful capital planning tools to our clients. Ms. Walleshauser graduated summa cum laude from University at Albany, State University of New York with a bachelor’s degree, double majoring in economics and mathematical and actuarial sciences, with a minor in business. Ms. Walleshauser passed the MSRB Series 50 Examination to become a qualified municipal advisor representative