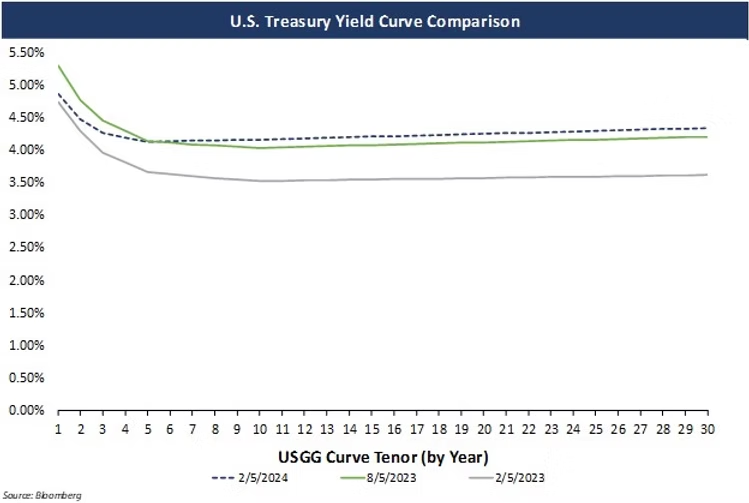

While the term “normal yield curve” refers to a positively sloping yield curve, the marketplace has become accustomed to an inverted yield curve for quite some time.

The treasury curve, from the 6-month to 30-year point, has been inverted since September 2022. We’ve seen this create a benefit for issuers and borrowers who can earn positive arbitrage on their project funds and refunding escrows as we’ve referenced in previous articles.

The front end of the yield curve remains the most inverted. In May 2023 the delta between the 1-year and 3-year rates averaged around 106 basis points. More recently, however, we’ve begun to see this delta narrow and the yield curve has started to slowly flatten. In January 2024, the difference between these rates averaged at about 69 basis points. It’s likely that we won’t see the slope of this point of the curve become positive until the Fed cuts short term rates, and we have heard from the last FOMC meeting that they will remain cautious to do so.

1. SLGS by Design

SLGS rates are designed to be 1 bps less than the treasury rate on any given day.

2. Tenor Rate Determination

3. Negative Carry

When bidding OMS, the winning dealer purchases the securities on the day of bid/pricing (again, typically 2-4 weeks prior to settlement), and must hold those securities until the settlement date when bond proceeds become available, and the issuer purchases the portfolio from the dealer. The dealer must fund their purchase at a rate for the period between pricing and settlement (typically 2-4 weeks), and when the yield curve is inverted this rate is often higher than the rate on the portfolio. The result is that the dealer must charge a negative carrying cost. In a positive sloping yield curve environment, the funding rate is often less than the rate on the portfolio, and the dealer can even offer a premium for this rate differential.

While these factors haven’t come into play yet, OMS continue to benefit conduit borrowers and issuers in other ways. For bond funds and taxable escrows that are not eligible for SLGS, OMS are a reliable alternative, and can often produce positive arbitrage earnings in the current market.

Blue Rose offers reinvestment advisory services for OMS portfolios, as well as repurchase agreements and guaranteed investment contracts. For a more tailored reinvestment indication to your specific fund(s) and a discussion of the risks and benefits to each type of reinvestment structure, please reach out to Georgina Walleshauser at [email protected].

Georgina Walleshauser, Vice President | 952-746-6036